Structured Finance Associates is focused on understanding and adding value to commercial real estate properties. Our emphasis is on reducing the capital required in constructing a new project or major renovation with our PACE+™ product, or decreasing property operating expenses with our NOI+ approach. In all of our products we can provide 100%, fixed rate, non-recourse financing with terms up to 25 years to implement our solutions.

REACHING

NEW HEIGHTS

ADDING VALUE TO

COMMERCIAL REAL ESTATE

So what is PACE?

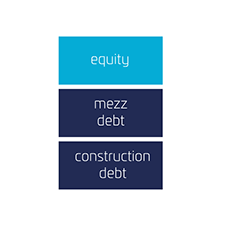

Say goodbye to old-school mezzanine debt.

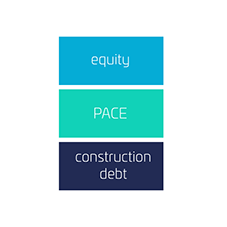

PACE (Property Assessed Clean Energy) is a revolutionary way to finance your building project that cuts the need for mezzanine debt and can half your interest due from the traditional 14% to close to 7.5%. The best part? PACE doesn’t require any financial covenants. If you need to get your project built (or remodeled!), you need PACE financing, and Structured Finance Associates are the PACE experts that have the skills and experience to get your deal done.

Mezz debt is a thing of the past with new PACE financing. Change up your capital stack and reap the rewards .

A simple switch can half

your interest due.

Our products are made to fit

your projects.

Whether you’re completing an energy-efficient update or building a new property, SFA has the products to help you achieve the maximum return on your investments - and each one is custom-tailored to fit your particular needs. We work one-on-one with our customers to make sure that you have the financing you need, and pride ourselves on a commitment to the principal that one size almost never fits all. Your project is unique, shouldn’t you have a financial partner that sees it that way? Start with one of our financing options and let us use PACE to do the hard work for you.

PACE+TM provides construction financing for office, retail, hotel, industrial, and multifamily projects yet to be built. It is the hottest financial choice for new buildings or significant renovations. You can combine existing sources of construction financing together with PACE (20% of cost) which allows a financing of up to 80% of the project. PACE+ can also cover major rehabs and remodels of existing buildings. SFA can even bring construction lenders to combine with PACE and streamline your financing!

Why choose PACE+TM?

- Finance up to 80% of your project’s cost subject to market conditions

- Take advantage of PACE’s non-recourse financing which carries a fixed rate for up to 25 years

- PACE doesn’t participate in the value and cash flow of your property

NOI+TM is a great option for leveraging PACE financing to make improvements or renovations on your existing property - renovations that can dramatically reduce your operating expenses and attract tenants for years to come. Increase your NOI by installing energy efficient lighting, plumbing, HVAC etc. Take advantage of Structured Finance Associates' expertise to finance your renovations and save.

NOI+TM is available for office, retail, industrial, hotel and multifamily properties nationwide and is available to finance any improvement that is not cosmetic. NOI+ finances:

- HVAC

- Elevators, escalators

- Windows, insulation

- Electrical and lighting

- Plumbing including fixtures

- Roof

- Solar and batteries

The Wiltern Center is a historic Art Deco complex comprised of the approximate 2,300 person capacity Wiltern Theater and the 12-story Pellissier Building with ground floor retail. The property is situated on 3.05 acre site on the southeast corner of Wilshire Boulevard and Western Avenue in the Mid-Wilshire area of Los Angeles. It is across the street from the MTA Purple Line subway station.

The building was constructed in 1931, renovated in 1983, with significant upgrades and repairs completed since 2007. Electrical and other utility savings exceeded the annual payments under the PACE financing resulting in an improved property with increased NOI and no out of pocket cash flow to the owner.

$4 million

$4.15 million

improvement total

NOI+ financing

This NOI+ project consisted of:

- Window Tint

- Lighting Retrofit

- Cooling Towers

- Controls

- Tower AC Unit

- Pumps

- Elevators

- HVAC

$10 million

PACE+ financing

Experience matters,

we're proud of ours.

As the saying goes, actions speak louder, and our past projects speak loudly. We've worked on some of the largest PACE financing deals to date and are breaking our own records one building at a time. Check out some of our recent financing projects and then contact us to get started on yours.

Case Study:

The Wiltern Center

Case Study:

The Missouri Theatre

The Missouri Theatre is located at 634 N. Grand Boulevard in the core of the historic theatre and arts district in Saint Louis, Missouri. The Missouri Theatre was one of the most popular theatres in St. Louis in the 1920’s. Originally constructed in November 1920 the project was completely rehabilitated turning it into a 146-room hotel with restaurants, meeting space and a 7,000 square foot rooftop lounge. In addition, the project contains ground floor retail and 21,000 square feet of office space.

SFA’s PACE+ provided approximately $10 million of PACE financing for the project. The PACE financing was non-participating, fixed-rate 20-year financing which was also non-recourse.

We're Structured Finance

Associates.

We're passionate financial professionals as comfortable in the board room as on a surfboard. Based in southern California and founded in 2010, SFA was formed to help owners of commercial real estate (office, retail, industrial, hotel and multifamily housing) increase their net operating income, NOI. Our goal is too add value to each and every property we work with by either decreasing operating expenses and/or increasing property revenues.

Let our team bring decades of financial experience and innovation to your commercial property. Contact us today!

You’re one message away from increasing the value of your property portfolio

Nothing more to see here. Back to top?